State of disaggregation today: do operators need it?

Network disaggregation is a new cloud-native approach to building telecoms networks. It involves dismantling the traditional integrated network equipment model by decoupling hardware and software, allowing telcos to select best-in-class solutions from different vendors.

This approach frees operators from vendor lock-in and creates a more open and competitive ecosystem. In turn, this lowers costs and increases flexibility and makes network automation easier.

Last year, we challenged the industry's reluctance to embrace the change to disaggregation in our ‘Manifesto’. This year, we wanted to test our assumptions with tangible data. So, we surveyed 200 senior telecom decision makers across three continents to find out what’s pushing disaggregation forward and what’s holding it back. To start, let’s look at what they said about the state of their existing networks, and whether they need disaggregation at all?

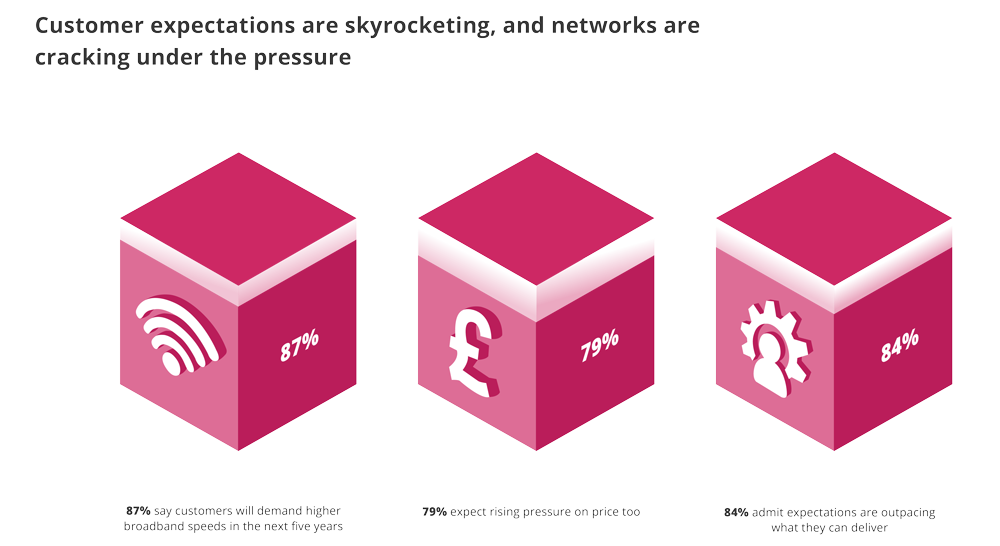

- Nearly nine in ten (87%) telecom professionals believe customer expectations for broadband speed will increase over the next five years

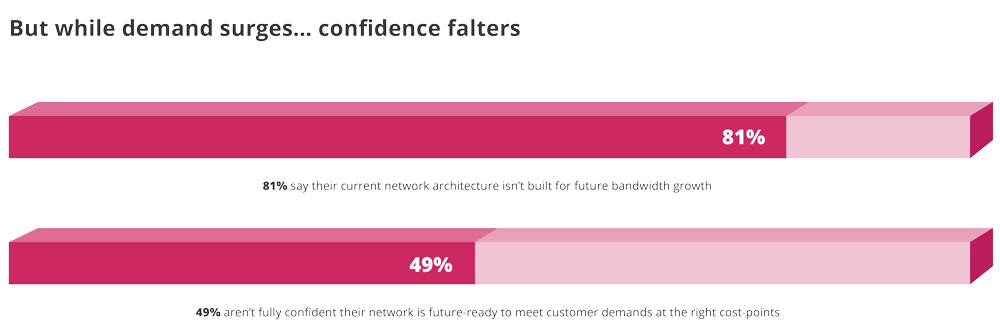

- 81% say their current network architecture is not suited to handle future bandwidth demand

Clearly, there are more users online today than ever before, and each of them is consuming more and more data. It should be no surprise, then, that they are expecting higher speeds from their broadband providers. Yet most operators are not confident in the ability of their networks to handle this increased level of demand

- Only half (51%) of operators are completely confident in the future readiness of their networks

- 84% say they’re already struggling to keep up with customer expectations

- 90% believe their organization needs to focus efforts on disaggregation deployment sooner than planned

Of concern for both consumers and operators, there is widespread recognition that today’s networks are already under strain, and half of respondents are not confident they can deliver what users expect in the future.

- 90% believe their organization needs to focus efforts on disaggregation deployment sooner than planned

The good news, in my view, is that there was a massive consensus across the industry that disaggregation will be key to meeting users’ expectations and that it needs to be in place sooner than operators expected.

So, what are operators doing in practice to solve these challenges?

In my next blog we’ll dive into some more data and look at how operators believe disaggregation can help, and when they expect to adopt it…

Richard Brandon

ABOUT THE DATA

The ‘State of Disaggregation’ research was independently conducted by Vanson Bourne between January 31 and February 24, 2025, and commissioned by RtBrick to identify the primary drivers and barriers to disaggregated network rollouts. The findings are based on responses from 200 senior telecom decision makers across the US, UK and Australia, representing operations, engineering and strategy at organizations with 100 to 5,000 employees.

FAQs

What is network disaggregation in telecoms?

Network disaggregation is a cloud-native approach that separates hardware and software within networking systems such as routers, allowing operators to choose best-in-class components from different vendors instead of being locked into a single-vendor.

Why do telecom operators need disaggregation?

81% of operators say their current network architecture isn’t suited to handle future bandwidth demand, and 84% are already struggling to keep up with customer expectations. Disaggregation provides the flexibility and scalability needed to address these challenges.

How many telecom decision makers participated in this research?

The study surveyed 200 senior telecom decision makers across the US, UK, and Australia, representing operations, engineering, and strategy roles.

What percentage of telecom professionals expect broadband demand to increase?

87% believe customer expectations for broadband speed will rise over the next five years.

How confident are operators in the readiness of their networks?

Only half (51%) of operators are completely confident their networks are ready to meet future demand.