RtBrick survey: Telco leaders warn AI/streaming to “crack networks” by 2030

This article was published in the IEEE blog on August 19, 2025, by Alan Weissberger. You can read the original article here.

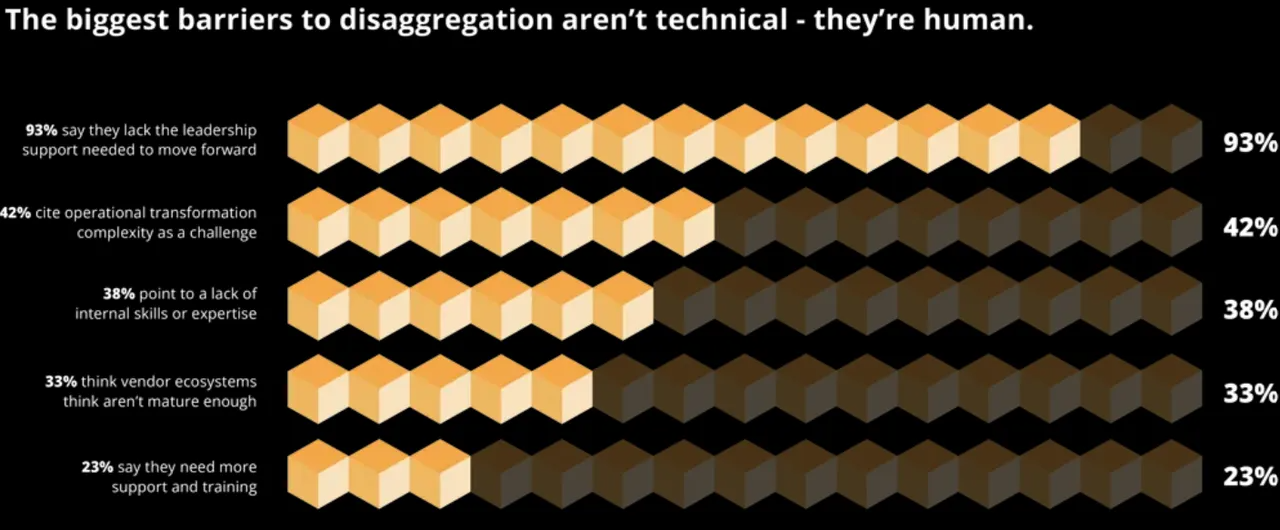

Respondents to a RtBrick survey of 200 senior telecom decision makers in the U.S., UK, and Australia finds that network operator leadership is failing to make key decisions and lacks the motivation to change. The report exposes urgent warnings from telco engineers that their networks are on a five-year collision course with AI and streaming traffic. It finds that 93% of respondents report a lack of support from leadership to deploy disaggregated network equipment. Key findings:

- Risk-averse leadership and a lack of skills are the top factors that are choking progress.

- Majority are stuck in early planning, while AT&T, Deutsche Telekom, and Comcast lead large-scale disaggregation rollouts.

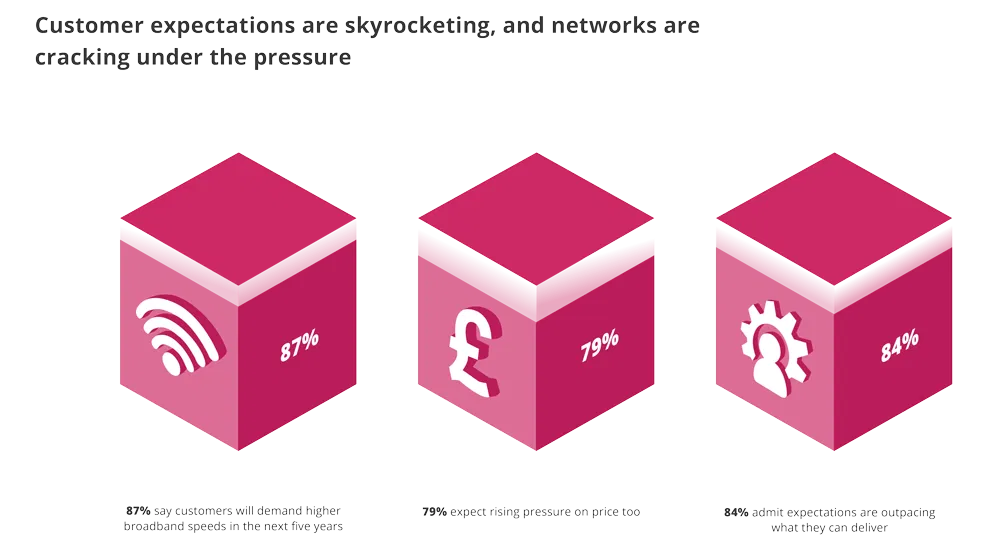

- Operators anticipate higher broadband prices but fear customer backlash if service quality can’t match the price.

- Organizations require more support from leadership to deploy disaggregation (93%).

- Complexity around operational transformation (42%), such as redesigning architectures and workflows.

- Critical shortage of specialist skills/staff (38%) to manage disaggregated systems.

The survey finds that almost nine in ten operators (87%) expect customers to demand higher broadband speeds by 2030, while roughly the same (79%) state their customers expect costs to increase, suggesting they will pay more for it. Yet half of all leaders (49%) admit they lack complete confidence in delivering services at a viable cost. Eighty-four percent say customer expectations for faster, cheaper broadband are already outpacing their networks, while 81% concede their current architectures are not well-suited to handling the future increases in bandwidth demand, suggesting they may struggle with the next wave of AI and streaming traffic.

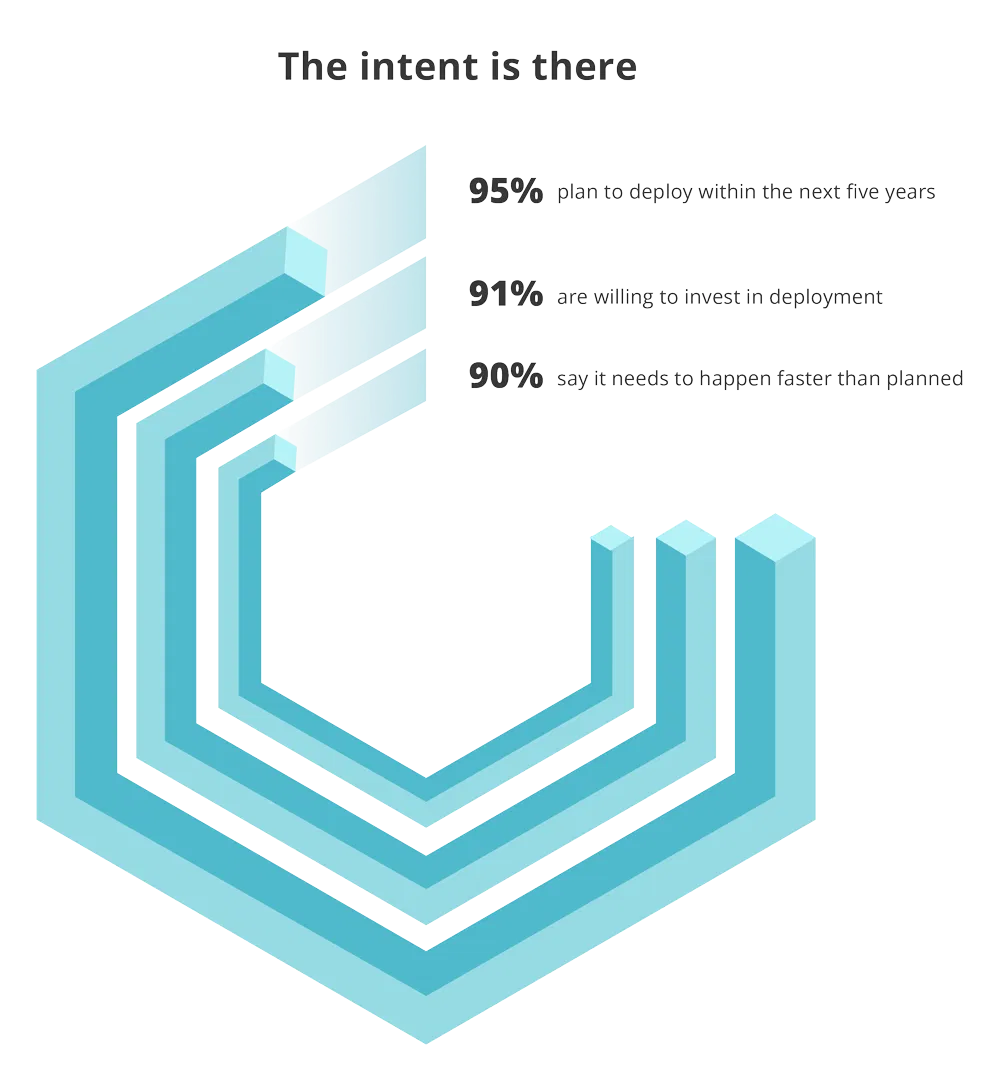

“Senior leaders, engineers, and support staff inside operators have made their feelings clear: the bottleneck isn’t capacity, it’s decision-making,” said Pravin S Bhandarkar, CEO and Founder of RtBrick. “Disaggregated networks are no longer an experiment. They’re the foundation for the agility, scalability, and transparency operators need to thrive in an AI-driven, streaming-heavy future,” he added noting the intent to deploy disaggregation as per this figure:

However, execution continues to trail ambition. Only one in twenty leaders has confirmed they’re “in deployment” today, while 49% remain stuck in early-stage “exploration”, and 38% are still “in planning”. Meanwhile, big-name operators such as AT&T, Deutsche Telekom, and Comcast are charging ahead and already actively deploying disaggregation at scale, demonstrating faster rollouts, greater operational control, and true vendor flexibility. Here’s a snapshot:

- AT&T has deployed an open, disaggregated routing network in their core, powered by DriveNets Network Cloud software on white-box bare metal switches and routers from Taiwanese ODMs, according to Israel based DriveNets. DriveNets utilizes a Distributed Disaggregated Chassis (DDC) architecture, where a cluster of bare metal switches act as a single routing entity. That architecture has enabled AT&T to accelerate 5G and fiber rollouts and improve network scalability and performance. It has made 1.6Tb/s transport a reality on AT&T’s live network.

- Deutsche Telekom has deployed a disaggregated broadband network using routing software from RtBrick running on bare-metal switch hardware to provide high-speed internet connectivity. They’re also actively promoting Open BNG solutions as part of this initiative.

- Comcast uses network cloud software from DriveNets and white-box hardware to disaggregate their core network, aiming to increase efficiency and enable new services through a self-healing and consumable network. This also includes the use of disaggregated, pluggable optics from multiple vendors.

Nearly every leader surveyed also claims their organization is “using” or “planning to use” AI in network operations, including for planning, optimization, and fault resolution. However, nine in ten (93%) say they cannot unlock AI’s full value without richer, real-time network data. This requires more open, modular, software-driven architecture, enabled by network disaggregation.

“Telco leaders see AI as a powerful asset that can enhance network performance,” said Zara Squarey, Research Manager at Vanson Bourne. “However, the data shows that without support from leadership, specialized expertise, and modern architectures that open up real-time data, disaggregation deployments may risk further delays.”

When asked what benefits they expect disaggregation to deliver, operators focused on outcomes that could deliver the following benefits:

- 54% increased operational automation

- 54% enhanced supply chain resilience

- 51% improved energy efficiency

- 48% lower purchase and operational costs

- 33% reduced vendor lock-in

Transformation priorities align with those goals, with automation and agility (57%) ranked first, followed by vendor flexibility (55%), supply chain security (51%), cost efficiency (46%) and energy usage and sustainability (47%).

About the research:

The ‘State of Disaggregation’ research was independently conducted by Vanson Bourne in June 2025 and commissioned by RtBrick to identify the primary drivers and barriers to disaggregated network rollouts. The findings are based on responses from 200 telecom decision makers across the U.S., UK, and Australia, representing operations, engineering, and design/Research and Development at organizations with 100 to 5,000 or more employees.

References:

https://www.rtbrick.com/state-of-disaggregation-report-2

https://drivenets.com/blog/disaggregation-is-driving-the-future-of-atts-ip-transport-today/