RtBrick: Telecoms Risk 'Kodak Moment' on Disaggregation

This article was published in Telco Magazine on September 15, 2025. You can read the original article here

New research from RtBrick shows that disaggregation is proven, but without bold leadership operators will lag behind demand and AI innovation

When Kodak invented the digital camera in 1975, it unknowingly held the future in its hands.

Yet, instead of embracing the breakthrough, Kodak’s leadership doubled down on film, the legacy business it knew best. The decision, or rather the indecision, set it on a path towards obsolescence.

Today, the telecoms industry stands at a similar crossroads.

Disaggregation – the separation of hardware and software to enable modular, flexible, multi-vendor networks – is proven. Operators across the globe are experimenting with it, demand for capacity is accelerating and the technology has demonstrated tangible business benefits.

Yet, many leaders remain hesitant, defaulting to legacy systems that feel familiar but are increasingly inadequate.

The readiness gap

On paper, operators appear prepared to embrace change. RtBrick’s State of Disaggregation report reveals that 9 out of 10 operators say they are willing to invest in disaggregation.

Meanwhile, 94% plan to deploy within five years and 9 in 10 admit they need to move faster.

But there is a yawning gap between intent and execution. “Only one in twenty operators is actually in deployment today. For an industry that prides itself on connecting the world, execution continues to stall,” Hannes explains.

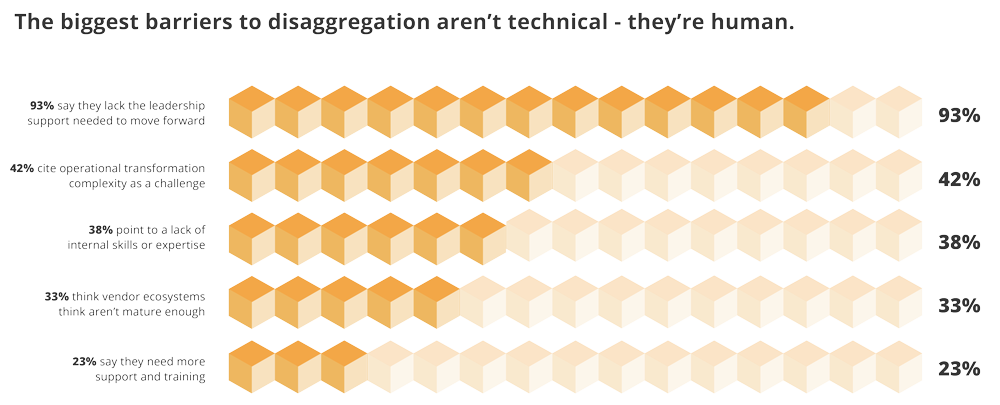

The mismatch is more than an executional delay, it’s a bottleneck in leadership. In fact, RtBrick's research reveals that 93% of operators feel they need more support from leadership to make disaggregation a reality.

For Hannes, the implications are stark. “This finding should stop the industry in its tracks," he says.

"And given what’s at stake, the cost of this leadership paralysis is becoming unforgivable.”

Why leaders freeze

Telecommunications has, for decades, operated on well-established rhythms. Leaders have grown accustomed to long-term vendor relationships, predictable technology refresh cycles and integrated single-vendor solutions.

Disaggregation essentially disrupts this paradigm.

“Disaggregation fundamentally challenges this model by separating hardware and software, allowing operators to mix and match components from different vendors," explains Hannes.

"It means abandoning the comfort of single-vendor solutions for the new horizons of multi-vendor ecosystems."

Hesitation, then, is rooted in more than conservatism. Leaders worry about integration headaches, additional layers of operational complexity and perceived risks to service continuity.

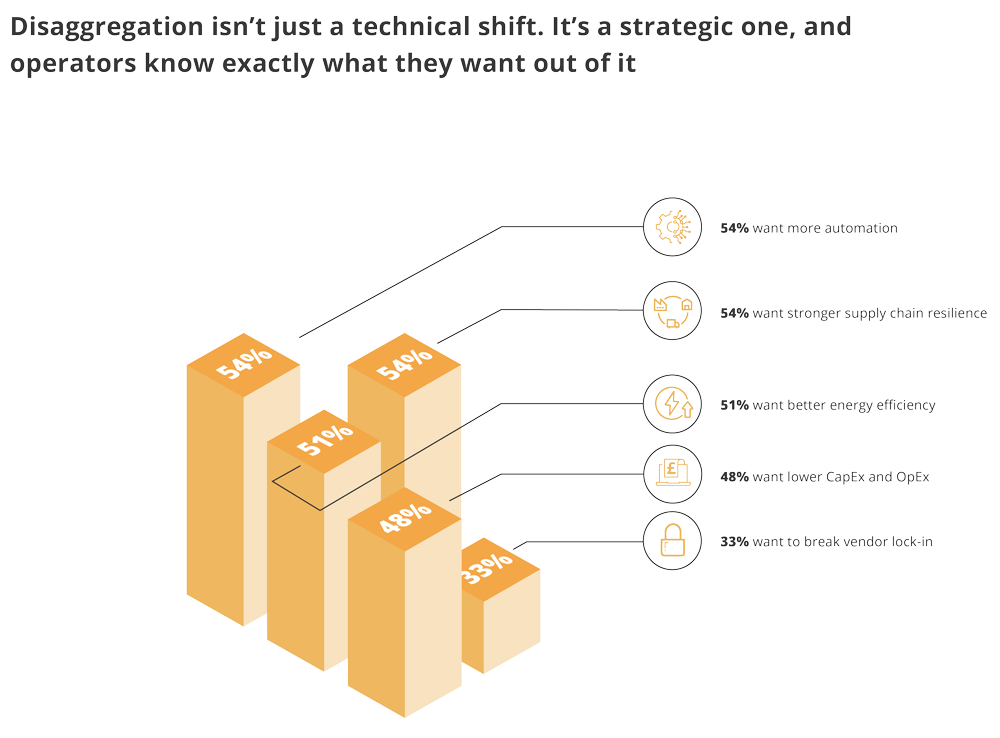

The RtBrick report highlights that 42% of operators cite operational transformation complexity as a barrier, while 38% point to skills shortages.

These concerns are understandable, but not insurmountable.

As Hannes argues: “These issues, however, are solvable with executive commitment and proper resourcing. The danger is that while leaders hesitate, the external pressures on networks continue to grow.”

By 2030, 87% of operators expect customers to demand higher broadband speeds | Photo: rtbrick

Rising stakes

The external pressures are formidable. By 2030, 87% of operators expect customers to demand higher broadband speeds. Already today, 84% say customer expectations are outpacing what their networks can deliver.

Even more worrying, 81% admit their current architectures are ill-suited to meet future demands, whether from exploding video traffic or the bandwidth-hungry rise of AI-driven applications.

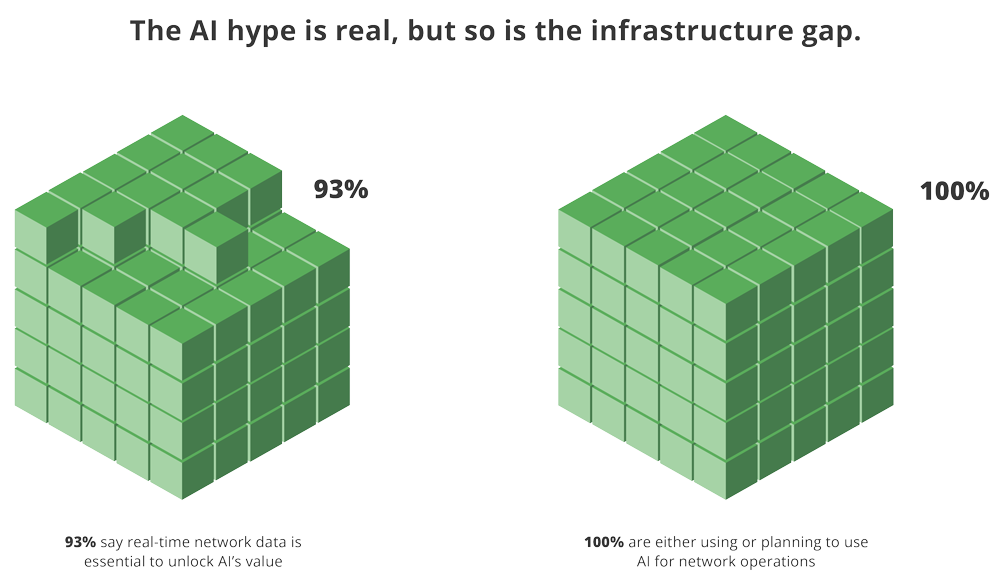

Artificial intelligence itself is a double-edged sword. Nearly every operator is either using AI in network operations or plans to. But the majority recognise that they cannot unlock AI’s full potential without richer, real-time network data.

“That level of observability simply isn’t possible with legacy, monolithic architectures. It requires open, modular, software-driven networks. In other words, disaggregation,” says Hannes.

The possibilities are transformative: autonomous fault detection, predictive maintenance and dynamic resource allocation. But these capabilities all hinge on granular, real-time telemetry data, something legacy systems cannot deliver at scale.

“Without disaggregation’s open interfaces and software-defined control planes, operators will be locked out of the AI revolution, transforming network management in the next decade,” Hannes warns.

In short, standing still is not neutral. It is actively falling behind.

Proof it works

For those who argue that disaggregation is still experimental, the evidence tells a different story. The major operators across the world have already demonstrated their viability and value.

AT&T, for example, has deployed disaggregated platforms across 52% of its core transport network traffic. The results are striking: a 50% reduction in planning time, a 40% improvement in order-to-service time and a 30% reduction in installation costs.

Deutsche Telekom, meanwhile, reports “significantly more flexibility and speed” thanks to near-complete automation and the freedom to independently select the best hardware and software for specific roles.

Comcast is leveraging disaggregated architectures to accelerate rollouts and gain greater control, while smaller players like WOBCOM have reported “substantially less cost, easier automation and far greater architectural flexibility.”

These are not marginal gains. They represent a fundamental shift in how networks can be built, managed and scaled.

“These are fundamental improvements in operational agility that translate to faster service launches and better customer responsiveness,” says Hannes.

Yet despite these success stories, nearly half of the industry remains stuck in planning or exploratory stages.

As Hannes cautions, “The competitive divide is widening and the laggards will be left struggling to retrofit outdated infrastructures while customer expectations race further ahead.”

The leadership imperative

What, then, does authentic leadership look like in the age of disaggregation? For Hannes, it begins with courage.

“Leadership support for disaggregation requires executive champions who can navigate incumbent vendor politics, mandate cross-functional collaboration and accept short-term operational risk for long-term strategic advantage,” he says.

It demands a mindset shift. Legacy models, dominated by closed, single-vendor systems, are increasingly at odds with the reality of fast-evolving network demands.

Successful disaggregation depends on a willingness to embrace multi-vendor environments, software-defined control and continuous operational evolution.

Leaders must champion collaboration between engineering, operations, procurement and business units.

They must be willing to disrupt entrenched vendor relationships and prepare their organisations to operate with greater agility.

Above all, leaders must recognise that inaction carries its own risks – ones far greater than the integration challenges they fear.

The cost of hesitation

The story of Kodak is a sobering reminder of what happens when leadership clings to the past in the face of transformative change.

For telecom operators, the risks are strikingly similar: being overtaken by more agile competitors, losing the ability to meet customer demands and locking themselves out of the innovations that will define the next decade.

“For operators, the choice has become whether to act decisively or fall behind," says Hannes.

"The decision rests squarely with leadership. Engineers are ready. The business case is there. The technology is proven. What is missing is the willingness to step out of the comfort zone of legacy architectures and place a bet on the future, like some telcos have already done,” says Hannes.

Those who make that bet stand to not only survive the next wave of demand but actively shape it.

“The leaders who recognise that and empower their teams to move now, will not only survive the next wave of demand, but they will also shape it,” argues Hannes.

“The rest risk being remembered as the operators who, like Kodak before them, knew what was coming yet failed to act.”

Telecommunications is entering a decisive decade. The pressures of customer demand, the opportunities of AI and the limitations of legacy systems are converging to create a tipping point.

Disaggregation is no longer theory; it is practice and it is already delivering measurable gains for those bold enough to embrace it.

Yet the industry risks falling into its own Kodak moment, where leadership inertia overshadows technical readiness and strategic foresight.

The path forward is clear: operators must summon the leadership to break free from outdated models and steer their organisations towards open, modular, software-driven architectures.

The future of telecoms won’t be defined by those who waited for comfort and certainty. It will be determined by those who, like Kodak, could have chosen to embrace the future before it became the present.