State of Disaggregation Report 2025

Operators believe in the promise of a disaggregated future, yet most are unprepared for it. Skills gaps and old-school leadership are keeping networks stuck in the past.

Last year, we challenged the industry's reluctance to embrace change in our ‘Manifesto’. This year, we took it a step further, backing our observations with tangible data.

We surveyed 200 senior telecom decision makers across the US, UK, and Australia to find out what’s pushing disaggregation forward and what’s holding it back.

The result?

An industry that’s ready for a fairer and open future, but somehow still chained to the past.

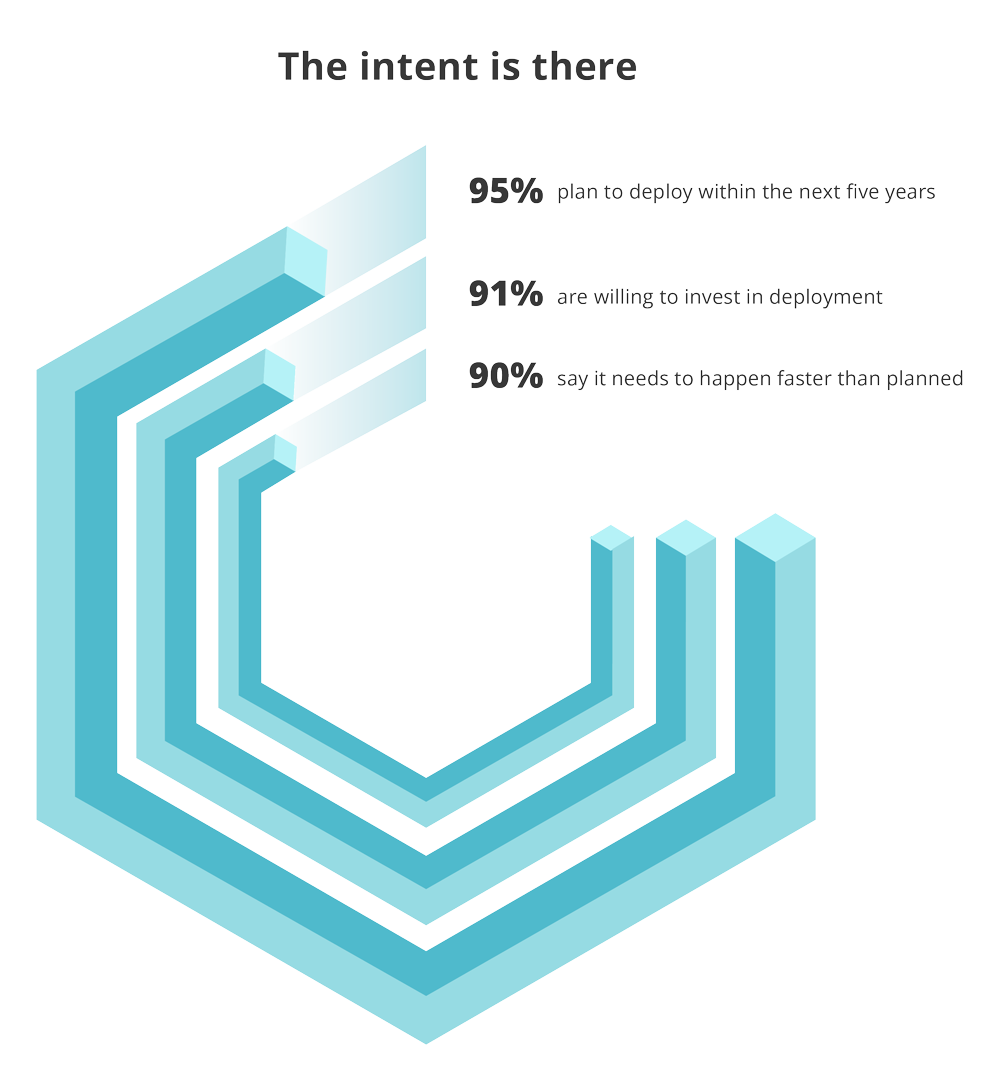

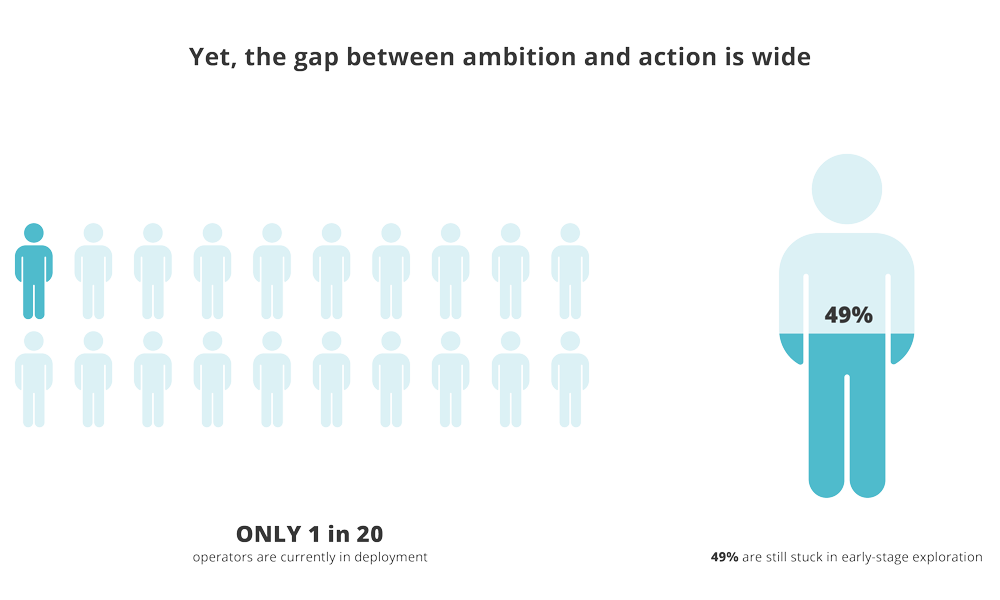

1. THE DISAGGREGATION PARADOX

“Operators want to deploy disaggregation. Most are unable to adapt.”

The case is clear. The ambition is real. However, progress is held hostage to legacy systems, rigid processes, and leadership that’s too comfortable with the status quo.

2. THE UNSEEN BLOCKERS

“Deployment is urgent. Core capabilities are missing.”

The technology is available. But lack of leadership support and skills gaps are killing progress. Disaggregation needs leaders willing to challenge comfort and drive change from the inside out.

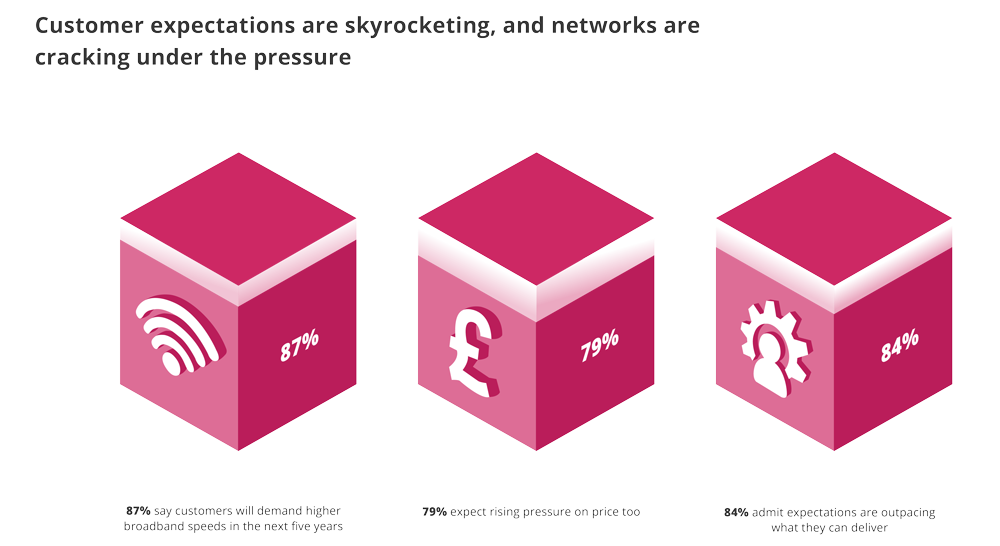

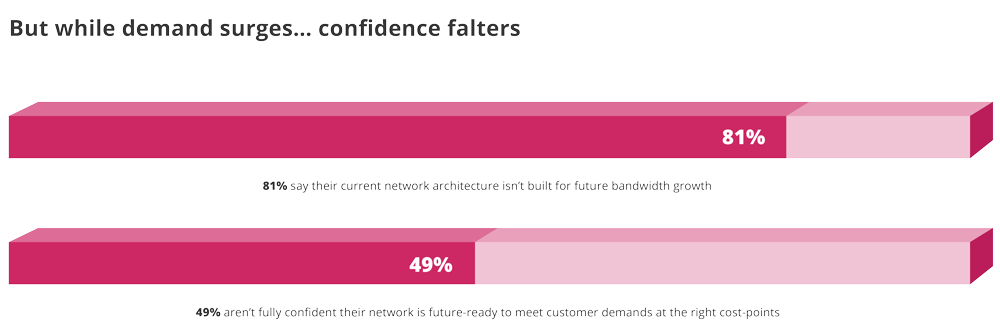

3. THE BANDWIDTH TIME BOMB

“Consumer demand is rising. Operator confidence isn’t.”

Users want faster broadband, yet nearly half of operators are unsure their networks can deliver. And with AI workloads and streaming demand exploding, that’s a problem.

4. THE TEST OF AI

“AI without the right network is a waste of investment.”

Everyone’s talking about AI. But here’s the truth: without disaggregation, your network can’t support the real-time operations AI needs. Disaggregation is the prerequisite for intelligent networking.

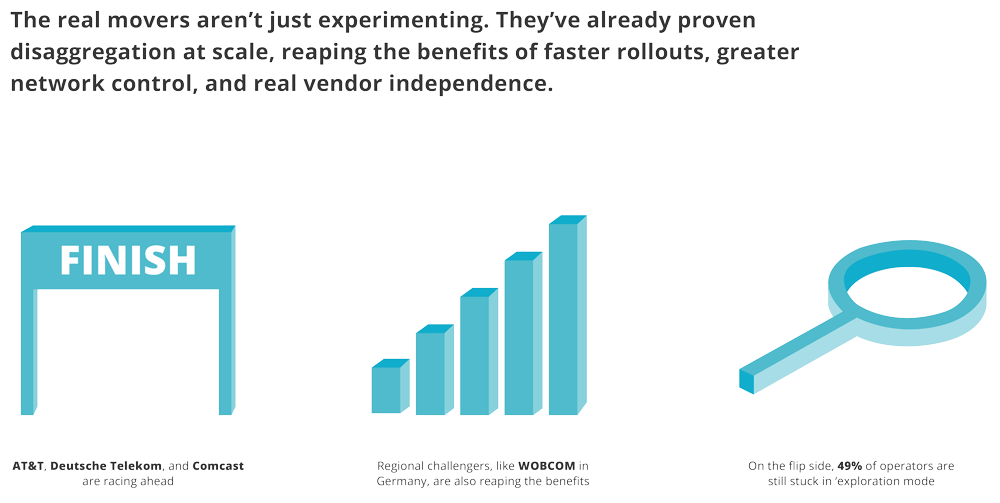

5. THE REAL WINNERS

“Disaggregation is already delivering. Who’s doing it best?”

The benefits are no longer theoretical. They’re measurable, and they’re already delivering. The gap is growing. Don’t risk being left stuck in the past while others charge forward.

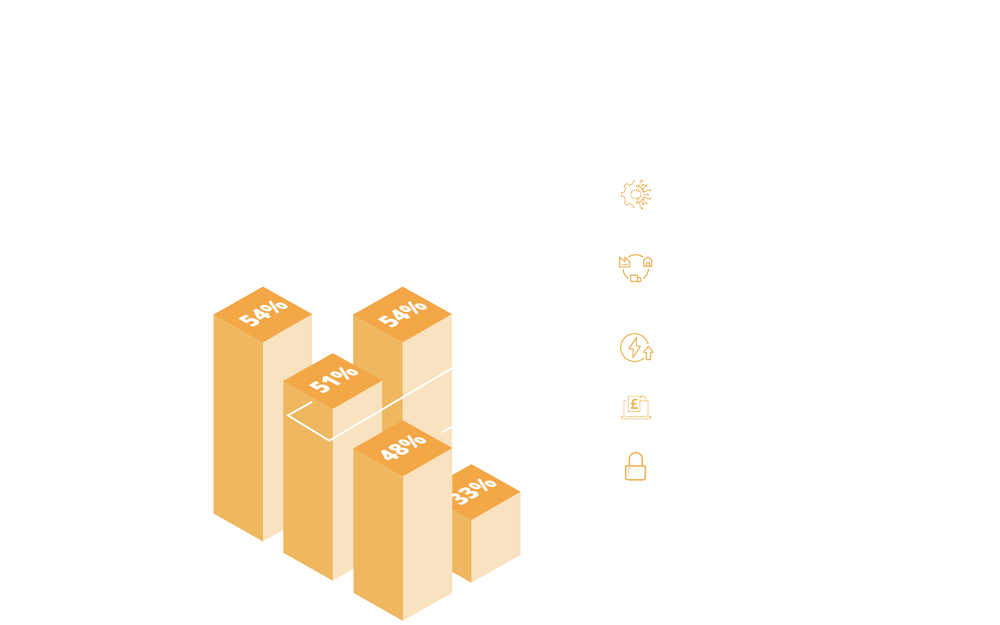

6. WHAT’S IN IT FOR YOU?

“You won’t survive the next decade on legacy architecture.”

Legacy stacks won’t deliver the speed, choice, or sustainability the next decade demands. Disaggregation does. It’s cheaper, greener, more agile, and it’s built for the networks of tomorrow.

THE WINDOW’S CLOSING. WHAT’S YOUR MOVE?

We’ve said it before: hesitation will be the industry’s downfall.

This report lays bare the real blockers to progress and the path forward. If telcos want out of vendor lock-in and into a future of open, flexible, and high-performance networks, the time to act is now!

No more excuses.

No more waiting.

The networks of tomorrow need decisions today.

Your move.

– BEHIND THE STATS –

ABOUT THE DATA

The ‘State of Disaggregation’ research was independently conducted by Vanson Bourne between January 31 and February 24, 2025, and commissioned by RtBrick to identify the primary drivers and barriers to disaggregated network rollouts. The findings are based on responses from 200 senior telecom decision makers across the US, UK, and Australia, representing operations, engineering, and strategy at organizations with 100 to 5,000 employees.