State of disaggregation today: everyone wants it, yet only some are doing it – why?

In my previous blog, State of disaggregation today: how do operators expect it to help, and when?, I looked at what telecoms operators were expecting from network disaggregation and when they expect to deploy it. This is according to new research from 200 senior telecom decision makers across three continents.

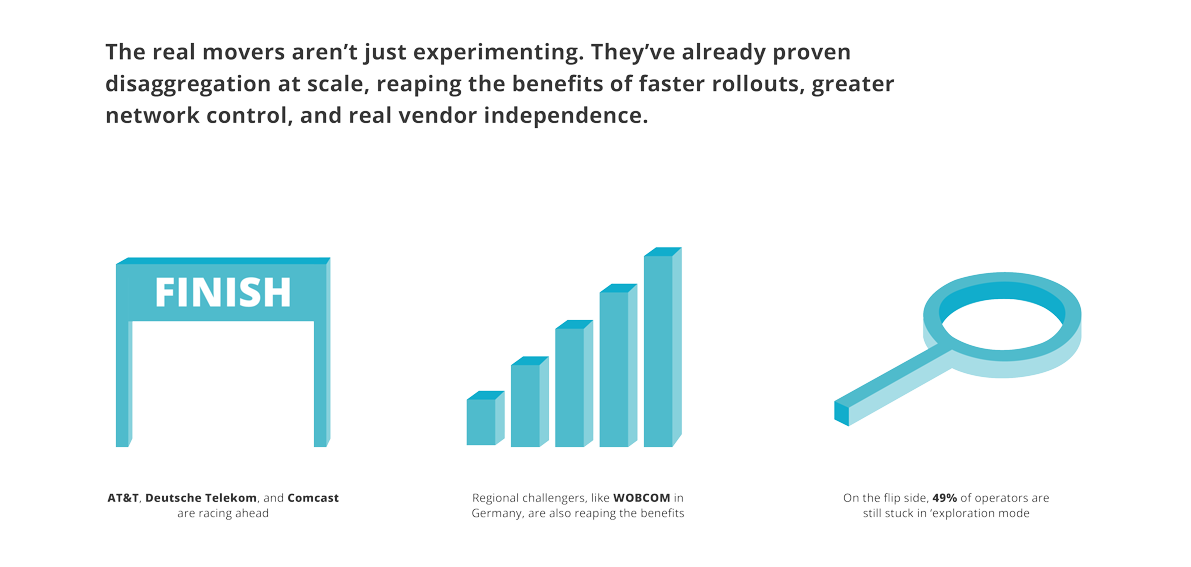

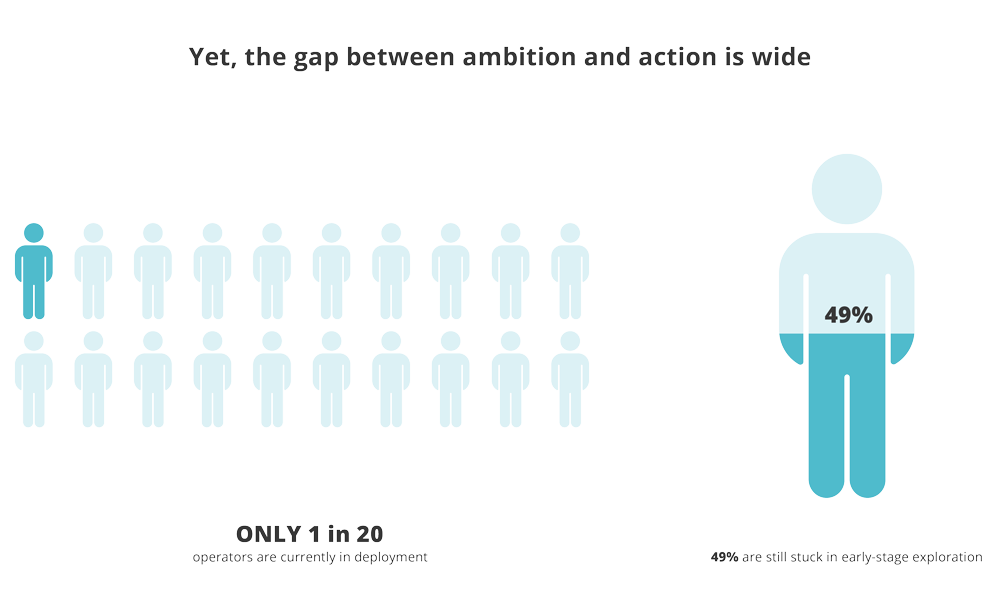

The benefits that operators said they expected were clear, and included increased automation (54%), stronger supply chain resilience (54%), lower environmental impact (49%) and reduced purchase and operational costs (48%). It explains why some major operators including AT&T, Comcast and Deutsche Telekom have already disaggregated parts of their networks, along with smaller ISPs such as WOBCOM and Citynet. Yet despite this momentum, and a general acceptance that disaggregation will bring many benefits, 86% of operators have yet to get past the planning and evaluation phase.

- 91% are willing to invest, yet only 1 in 5 have deployed

- 90% agree deployment needs to happen faster

The consensus is clear, but action remains elusive. So, if the technology is mature enough to satisfy the needs of both Tier-1 operators and smaller ISPs, and the vast majority think it needs to happen now, why the delay in implementation? Let’s look at what is holding back those who haven’t got started yet:

- 93% say they need more leadership support to make it happen

- 42% and 38% cite operational transformation and skills shortages as barriers to disaggregation

- Training, integration and interoperability top the list of things needed to make deployment a reality

Clearly, it isn’t about the maturity or robustness of the technology, it is about people. Many of those questioned didn’t believe their leadership had the appetite to move away from their legacy vendors and engage with the new wave of disaggregated vendors. Others felt that they didn’t have the modern IT skills to implement cloud-native systems. And some felt that the integration of different disaggregated components was the biggest barrier, though they must have overcome those barriers already in the world of computing, where hardware and software have been uncoupled for decades.

The report, and my blog post here, don’t claim to have easy answers to these challenges. But if the disaggregated laggards believe that it is people issues that are holding back something they believe urgently needs to be happen, then we wonder whether those same people will stand by and watch for much longer before they lose touch with their competitors? Whatever they do, the shift towards disaggregation seems inevitable. The only questions that remain are:

- Who is going to disaggregate next?

- Who will be the big winners?

- Who is going to get left behind?

If you’d like to know more about the state of disaggregation today, you can read the full report here.

Richard Brandon

ABOUT THE DATA

The ‘State of Disaggregation’ research was independently conducted by Vanson Bourne between January 31 and February 24, 2025, and commissioned by RtBrick to identify the primary drivers and barriers to disaggregated network rollouts. The findings are based on responses from 200 senior telecom decision makers across the US, UK and Australia, representing operations, engineering and strategy at organizations with 100 to 5,000 employees.

FAQs

Why are operators slow to adopt network disaggregation?

Despite 91% being willing to invest, operators face significant organizational barriers. Many cite lack of leadership support, operational transformation challenges and skills shortages as barriers to adoption.

What is the biggest barrier to disaggregation?

93% of respondents said they need stronger leadership support, while others pointed to integration and interoperability across multiple vendors.

How many operators have moved beyond the planning stage?

86% of operators are still in planning or evaluation, and only 1 in 5 have deployed disaggregation so far.

What percentage of operators have live disaggregated systems?

Just 6% of operators have fully or partially deployed live disaggregation in their networks. I

s disaggregation considered inevitable?

Yes, most operators agree that disaggregation is essential, and those who delay risk falling behind competitors.