State of disaggregation today: how do operators expect it to help, and when?

In our previous blog, State of disaggregation today: do operators need it, I looked at the state of existing telecoms networks and their readiness to deal with future growth, according to new research from 200 senior telecom decision makers across three continents.

Now I want to share some more of the data from that same survey, which reveals what operators hope to achieve from network disaggregation, and when they expect to deploy it.

Let’s look first at the benefits that operators said they expected, which include:

- increased automation (54%)

- stronger supply chain resilience (54%)

- lower environmental impact (49%)

- reduced purchase and operational costs (48%)

Disaggregation replaces proprietary monolithic network systems with a modern cloud-native approach, based on open APIs, RESTCONF and YANG models. Access to hardware and software is open, and highly granular. All of this makes it easier to interrogate and control multiple vendors’ systems and to automate operations.

The importance of a more resilient supply chain came as something of a surprise to me, if I’m honest. Maybe we take some of the benefits of a disaggregated ecosystem for granted. The software is usually supplied from countries in trusted democracies, so isn’t likely to be restricted by geopolitical concerns.

And the open hardware can be exchanged between different vendors relatively easily in the event of a supply bottleneck. Even an identical switch is often manufactured in multiple countries (Taiwan, Vietnam, India, and so on) further insuring against unforeseen disruptions.

An open switch is usually available with a lead time of a few weeks, for example, rather than a few months.

Open switches are usually more power efficient than their traditional counterparts, as they benefit from using more up-to-date silicon. This ‘merchant silicon’ comes to market and is integrated with software much faster than proprietary silicon. On top of that, the switches themselves can be easily repurposed to extend their lifespan simply by running alternative software, turning them from a core to an edge router, for example, or into a CGNAT device.

Lower cost is perhaps one of the most compelling advantages of disaggregation. The open hardware is a fraction of the cost of legacy networking systems, and the competitive choice of software, along with the ability to mix and match with hardware, will help keep prices lower than traditional vendors, who can lock their customers in with endless upgrades to chassis-based systems.

Taken as a whole, it is clear that operators believe these benefits make disaggregation a compelling strategic move for long-term efficiency and competitiveness.

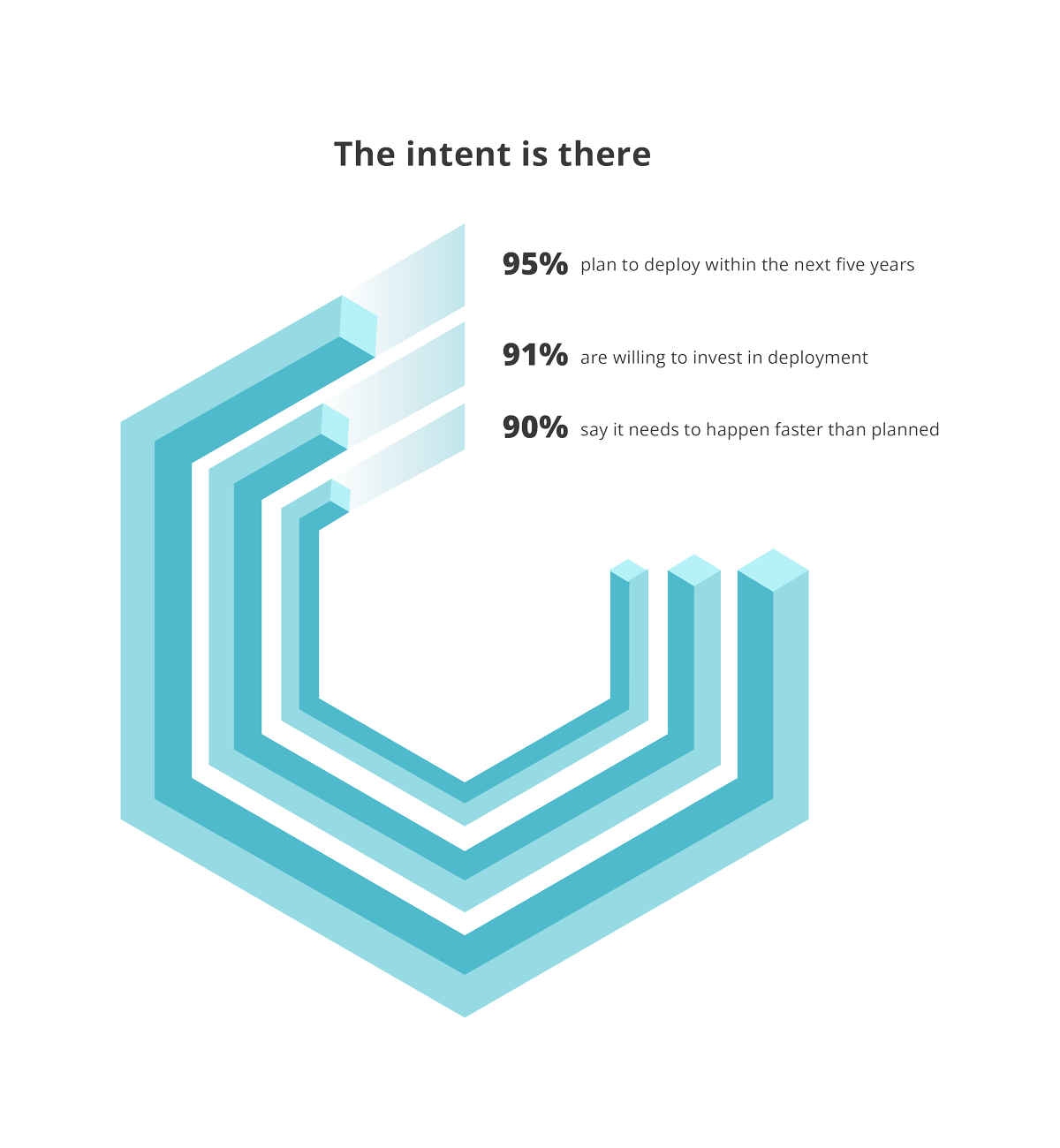

So, having said that, when do they expect to be deploying disaggregated systems in their live operational networks?

- Almost all (95%) telecommunications organizations are looking to deploy a disaggregated network system within the next 5 years, with many in the exploration (49%) or planning (38%) phase

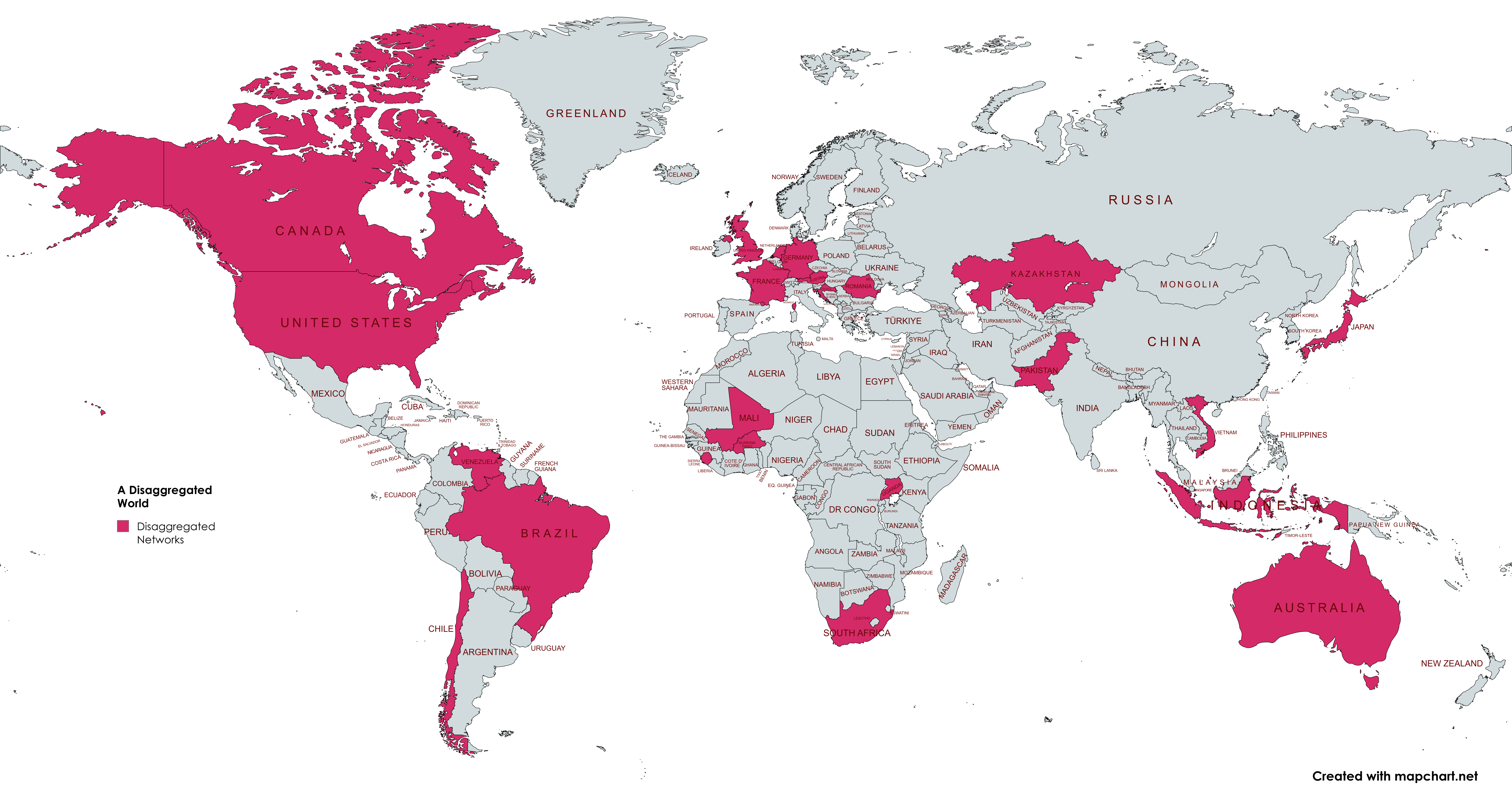

Some are already enjoying the benefits, with live disaggregated systems in their networks. These include some high profile operators such as AT&T, Comcast and Deutsche Telekom, as well as smaller regional operators such as WOBCOM and Citynet.

We can see that on our world map, which highlights countries where we are aware of existing live disaggregation deployments in telco networks.

But perhaps what is more surprising is that more of this map isn’t filled in yet. After all, given the benefits that operators say they expect to gain from disaggregation, those slow to adopt are going to fall behind and become uncompetitive.

- Only a minority of operators (14%) are currently in a testing or pilot phase, or have already deployed network disaggregation

- Only a few (6%) of operators have fully or partially implemented live deployments

In our next blog we’ll look a bit deeper into why some operators are still holding back, and what they need to do to benefit from the change….

Richard Brandon

ABOUT THE DATA

The ‘State of Disaggregation’ research was independently conducted by Vanson Bourne between January 31 and February 24, 2025, and commissioned by RtBrick to identify the primary drivers and barriers to disaggregated network rollouts. The findings are based on responses from 200 senior telecom decision makers across the US, UK and Australia, representing operations, engineering and strategy at organizations with 100 to 5,000 employees.

FAQs

What benefits do telecom operators expect from network disaggregation?

According to the survey, the top expected benefits include increased automation (54%), stronger supply chain resilience (54%), lower environmental impact (49%) and reduced costs (48%).

How does disaggregation improve supply chain resilience?

Open hardware can be sourced from multiple vendors and manufactured in different countries, reducing the risk of bottlenecks and delays.

How many telecom organizations plan to deploy disaggregation?

95% of operators expect to deploy disaggregated systems within the next five years, with many already in the exploration or planning phase.

Which operators have already adopted disaggregation?

Major players like AT&T, Comcast and Deutsche Telekom, along with regional providers such as WOBCOM and Citynet, already have fully operational disaggregated systems in their networks.